There is an age-old saying that holds that prevention is better than cure. This principle needs to be applied more rigorously in the relationship between insurers, insurance brokers and business clients, argues Andre van Der Merwe, head of Corporate Property at Hollard. “Each partner in the short-term insurance value chain should always remember that it is better to mitigate or prevent the many risks that businesses face rather than trying to ‘fix’ things following a loss event,” says Van Der Merwe.

“It is only when the steps taken to mitigate a risk fail, that insurers make good on the promise to return firms to their pre-loss position as quickly as possible and with the minimum disruption.”

South Africa’s constantly evolving risk environment makes a holistic approach to risk management and business insurance more important today than ever. “The risk landscape, whilst not hostile, is indeed extremely challenging, and requires that insurers work closely with brokers and risk managers to limit overall exposures to risk events,” he says.

It is common knowledge that ageing municipal infrastructure, inadequate maintenance and poor service delivery increase both the frequency and severity of risk events. Fire is one example - poor performance from local fire departments has led to a sharp spike in claim pay-outs following industrial fires.

However, municipalities are not the only party at fault. “Fires are costing the insurance industry millions each year due to a combination of municipal and private sector failures, including poor maintenance of fire protection equipment and inadequate fire protection within the built environment,” says Van Der Merwe.

Aside from the risks posed by fire, South African businesses must also consider the impact of adverse weather events such as flooding and heavy storms. Damage due to flooding and hail can run into millions of rand and cause severe damage to buildings, manufacturing equipment, motor vehicle fleets and stock in trade at firms.

“We have a deep understanding of the risks that businesses face and are ready, with the assistance of our experienced commercial insurance broker partners, to assist businesses both with risk mitigation strategies and with structuring suitable insurance solutions that will pay out when the mitigation efforts fail,” says Van Der Merwe.

An experienced insurer can help businesses to secure cover for risk events that were previously unheard of. One such example is the inconsistent supply of electricity that introduces significant risk, but one that differs from business to business. “The cost to businesses due to electricity outages goes way beyond lost production,” says Van Der Merwe. “An example of such incremental cost is stoppages in industrial processes caused by the water crisis that developed in areas around Johannesburg due to the electric power station suffering too much downtime.”

Another bugbear for businesses in South Africa is organised crime, with cash-in-transit heists and ATM bombings making headlines on a regular basis. There has also been a noticeable increase in mobile device thefts with many businesses struggling to obtain insurance for such products. And that is even before the impact of the growing Cyber-crime trend is considered.

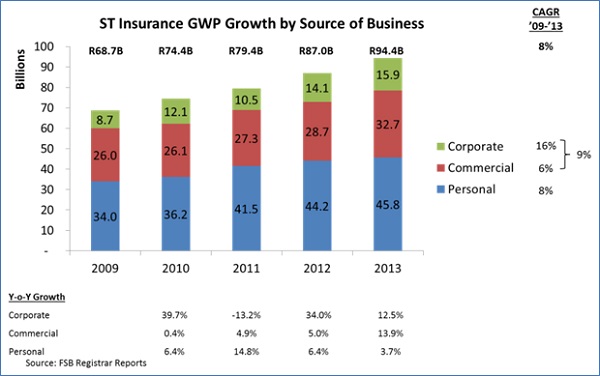

The need for more comprehensive insurance cover appears to be getting through to local business owners and executives. According to the Financial Services Board’s industry statistics, the commercial and corporate segments of the short-term insurance market have grown at 9% per annum over the past four years, topping the growth achieved in the personal lines (private households) space.

Businesses now account for almost half of all short-term insurance premiums, accounting for R46 billion of the R94 billion collected in the latest year. Most of this business is facilitated by intermediaries.

“Local businesses are struggling to make ends meet due to the country’s sluggish economy and the knock-on effect on the spending power of their clients,” concludes Van Der Merwe. “The last thing they can afford to do is to drop the ball where risk mitigation and insurance are concerned.”

“It is precisely in these gloomy times that businesses should increase their vigilance by aggressively scanning the risk environment, reviewing their short-term insurance policies with assistance from an experienced broker and making sure that that all possible loss events are covered.”

Insurance that covers a firm for every conceivable risk is a ‘must have’ for South Africa’s business executives as they navigate today’s complex risk environment, but it must go hand in hand with proper risk mitigation and recovery strategies.