October is Breast Cancer Awareness Month, and there’s never been a better time to ask yourself the question: Will you be financially, physically and emotionally secure if you are diagnosed with cancer?

Hayley Taylor, head of underwriting at Hollard Life, warns that cancer often has no telltale signs in its early stages, It’s one of the reasons why there is such an emphasis on pre-emptive screening and routine health checks.” says Hayley.

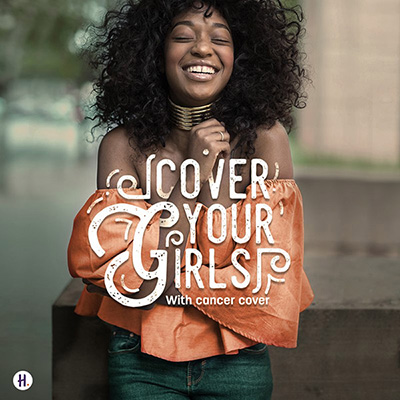

Hollard hopes to encourage early detection with its #CoverYourGirls campaign and the truth is that “beating cancer comes at a huge cost – emotionally, physically and most definitely financially, ” she says.

So, what does cancer treatment cost?

Quite simply, the cost of cancer treatment can be enormous, and having only medical aid won’t cut it. Depending on the type of cancer and treatment, being diagnosed with cancer could cost anything from a few thousand to R800 000 per case.

Many medical schemes place limits on oncology benefits and exclude expensive, advanced treatments such as biological therapy. This means that a lot of people who are diagnosed with cancer suddenly find themselves having to self-fund some of their treatment, not to mention other unexpected recovery costs.

Can you afford to do this? For most of us, the answer is no.

“The cost of rehabilitation during remission goes far beyond medical treatment. There’s also the loss of income while you’re unable to work, shortfalls between medical aid rates and specialist fees, as well as any lifestyle changes you need to make as a result,” says Hayley.

“For example, what happens when you’ve reached the limit of your medical aid’s oncology benefits, but you need further treatment?”

You need a plan. Like, yesterday

Many people wrongly assume critical illness and disability cover are replacements for medical aid. The truth is, that a well-structured healthcare portfolio includes traditional medical aid as well as critical illness, disability and income protection benefits, and gap cover. It takes an experienced eye to get this balance right – and that’s where you need the help of an experienced financial planner.

Being diagnosed with a serious illness like cancer can knock you off your feet – and knock your finances at the same time. But there is hope.

A good financial plan ensures that you can afford your preferred treatment, the best technology available and the best post-treatment options. You will also be in a position to sustain your standard of living, even if you are unable to earn an income. It all starts with having a conversation with your financial adviser – so have that talk today.

Speak to your financial advisor/client about comprehensive cancer cover that gives you complete coverage from stage 0 to stage 4 cancer, which means that you can focus on bouncing back while we look after the rest.